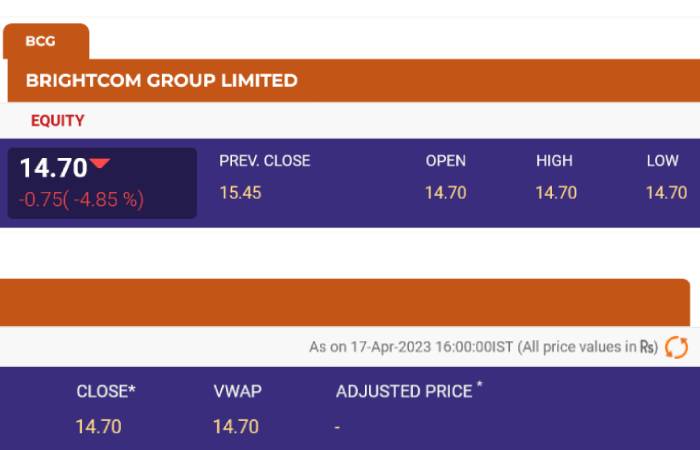

What are Nse:bcg Financials?

nse:bcg financials is the information of bcg financials provided by NSE. The NSE has added bcg financials to their website and also has given their full latest updated details. As of 17th of April, 2023, its rate or price is 14.70, which has been decreased by the previous one by -0.75(-4.85%), which is 15.45. The other values are listed below:

Open – 14.70

High – 14.70

Low – 14.70

Close – 14.70

VWAP – 14.70

nse:bcg financials also gives details like trade information, corporate information, pre-open market, intraday chart, historical data and also glossary. All the information is categorized into these sub-headings.

Trade Information – nse:bcg financials

nse:bcg financials

Order Book

The section Order Book contains four tables in it. The first table talked about the sell quantity and also marked it as 10,74,817, and also the Ask (in rupees) is 14.70. The second table contains the trade information. Here, we have the following details:

Traded Volume (Shares): 37,25,836

Traded Value (in rupees lakhs): 547.70

Total Market Cap (in rupees lakhs): 2,96,634.52

Free Float Market Cap (in rupees lakhs): 1,92,812.43

Impact cost: 0.14

The third table is about the price information. The things mentioned in this table are:

52 Week High (as per 13-Apr-2022): 102.40

52-Week Low (as per 31-Mar-2023): 12.00

Upper Band: 16.20

Lower Band: 14.70

Price Band: 5

The last table is the Value at Risk percentage table. In this table, they have added the values of things like:

Security VaR: 31.61

VaR Margin: 31.61

Extreme Loss Rate: 3.50

Adhoc Margin: 64.89

Applicable Margin Rate: 100.00

Apart from this, the order book section gives us information about even more things which are listed below:

Series: EQ

Symbol: BCG

ISIN: INE425B01027

Status: Listed

Date of Listing: 08-May-2015

Basic Industry: IT Enabled Services

Symbol P/E: 2,008.56

Sectoral Index P/E: 23.62

Sectoral Index: NIFTY IT

Securities Information

nse:bcg financials – The securities information is one more sub-heading of the trade information section. It provides us with all the information related to the security of nse:bcg financials.

Board Status: MAIN

Trading Status: ACTIVE

Trading Segment: NORMAL MARKET

SLB: NO

Class of Shares: EQUITY

Derivatives: NO

Face Value: 2

Issued Capital (Shares): 2,01,79,21,873

Surveillance Indicator: LTASM – I (13)

What is NSE? – nse:bcg financials

nse:bcg financials – National Stock Exchange is one of the world’s top largest exchanges and also plays an essential role in operating India’s lucrative growth. It is a self-made label which has reached great heights. NSE is a social stock exchange website and also stands for National Stock Exchange. It is basically at the country level and also spread to the international level. NSE is a trusted institution of market framework and also has high grades of collaborated governance.

In 1994, NSE introduced electronic trading in India and also became the first exchange to operate screen-based trading. The NSE is a pioneer in technology trading and investments. It always aims to run a market environment that promotes efficiency and also transparency. NSE’s solid and also modern platforms provide good standards of security, safety, robustness and flexibility to all types and categories of investors for trading and also investment.

What is bcg Financials?

Bcg financials is a page on the Brightcom Group website that shows the “Financials” section. In this financials section, they have provided several PDFs, mainly of the financial results of different years and also categories. Some of the listed PDFs are as follows:

- Audited Financial Results FY 2021-22

- Related Party Transactions for H2 FY2

- Audited Financial Results FY 2020-21

- Audited Financials FY 2013-2014

In bcg financials, BCG stands for Brightcom Group. It contains businesses related to IoT, Ad-tech and also New Media worldwide. They have numerous popular and successful brands as their clients, including vehicle brands like Maruti Suzuki, Hyundai Motors, British Airways and also Qatar Airways. The mobile and also television-related clients they have are Vodafone, Samsung, Airtel, Viacom, Sony, Star India, etc. Brightcom Group is spread worldwide in countries like the United States, Israel, Western Europe, Asia Pacific regions and also Latin America ME.

nse:bcg financials work with agencies such as JWT, Havas Digital, Mediacom, Neo@Ogilvy, Mindshare, Ogilvy One, Satchi&Satchi, OMD, TBWA, ZenithOptiMedia and also many more. Bcg also has publishers like Twitter, Yahoo!, Facebook, LinkedIn and also MSN. When it comes to customer products, bcg aims at IoT (Internet of Things). Their goal is to make products dedicated to the future of information management and also communication in daily-life things connected to the IoT.

Bcg financials Clients

nse:bcg financials – As the Brightcom Group is a successful media and very popular, it has many famous and high-graded brands as their clients. bcg financials provides its services to these brands, so they become their clients. Following is the list of their clients:

- Tremor Video

- App Nexus

- Smart Ad Server

- Bright Roll

- Criteol

- DD

- GSN

- Improve Digital

- CBS Interactive

- Little Things

- Media Math

- Publir

- PubMatic

- Reckitt Benckiser

- Spotx

- WND

- com

- Clarinx

- OpenX

- Ooyala

- Fyber

- Lastly, Microsoft

Brightcom Group Team

Founders

nse:bcg financials, or Brightcom Group, was founded by Suresh Reddy, and he is the chairman and also CEO of the company. Vijay Kancharla is the Chief Innovation Officer at BCG.

Management

Firstly, Suresh Reddy – Chairman and CEO

Secondly, Vijay Kancharla – Chief Innovation Officer

Thirdly, Satish Cheeti – President & Division Chief ( Brightcom Audio)

Bradley N Cohen – President & Chief Strategy Officer

Narayana Raju – CFO

Peshwa Acharya – President – Group Strategy

Lastly, Shreedhar Reddy – General Manager, Indian Operations